Page 34 - IB Dec 2020

P. 34

SPBD SPBD

pandemic and resulting economic impacts impacted SPBD?

What adjustments have you made?

GC: 2020 has indeed been an extraordinary and difficult

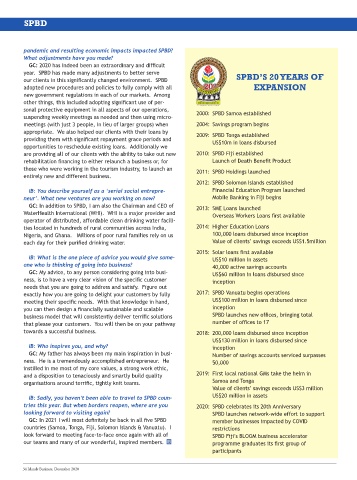

year. SPBD has made many adjustments to better serve SPBD’S 20 YEARS OF

our clients in this significantly changed environment. SPBD

adopted new procedures and policies to fully comply with all EXPANSION

new government regulations in each of our markets. Among

other things, this included adopting significant use of per-

sonal protective equipment in all aspects of our operations, 2000: SPBD Samoa established

suspending weekly meetings as needed and then using micro-

meetings (with just 3 people, in lieu of larger groups) when 2004: Savings program begins

appropriate. We also helped our clients with their loans by 2009: SPBD Tonga established

providing them with significant repayment grace periods and US$10m in loans disbursed

opportunities to reschedule existing loans. Additionally we

are providing all of our clients with the ability to take out new 2010: SPBD Fiji established

rehabilitation financing to either relaunch a business or, for Launch of Death Benefit Product

those who were working in the tourism industry, to launch an 2011: SPBD Holdings launched

entirely new and different business.

2012: SPBD Solomon Islands established

IB: You describe yourself as a ‘serial social entrepre- Financial Education Program launched

neur’. What new ventures are you working on now? Mobile Banking in Fiji begins

GC: In addition to SPBD, I am also the Chairman and CEO of 2013: SME Loans launched

WaterHealth International (WHI). WHI is a major provider and Overseas Workers Loans first available

operator of distributed, affordable clean drinking water facili-

ties located in hundreds of rural communities across India, 2014: Higher Education Loans

Nigeria, and Ghana. Millions of poor rural families rely on us 100,000 loans disbursed since inception

each day for their purified drinking water. Value of clients’ savings exceeds US$1.5million

2015: Solar loans first available

IB: What is the one piece of advice you would give some- US$10 million in assets

one who is thinking of going into business? 40,000 active savings accounts

GC: My advice, to any person considering going into busi- US$60 million in loans disbursed since

ness, is to have a very clear vision of the specific customer inception

needs that you are going to address and satisfy. Figure out

exactly how you are going to delight your customers by fully 2017: SPBD Vanuatu begins operations

meeting their specific needs. With that knowledge in hand, US$100 million in loans disbursed since

you can then design a financially sustainable and scalable inception

business model that will consistently deliver terrific solutions SPBD launches new offices, bringing total

that please your customers. You will then be on your pathway number of offices to 17

towards a successful business. 2018: 200,000 loans disbursed since inception

US$130 million in loans disbursed since

IB: Who inspires you, and why? inception

GC: My father has always been my main inspiration in busi- Number of savings accounts serviced surpasses

ness. He is a tremendously accomplished entrepreneur. He 50,000

instilled in me most of my core values, a strong work ethic,

and a disposition to tenaciously and smartly build quality 2019: First local national GMs take the helm in

organisations around terrific, tightly knit teams. Samoa and Tonga

Value of clients’ savings exceeds US$3 million

IB: Sadly, you haven’t been able to travel to SPBD coun- US$20 million in assets

tries this year. But when borders reopen, where are you 2020: SPBD celebrates its 20th Anniversary

looking forward to visiting again? SPBD launches network-wide effort to support

GC: In 2021 I will most definitely be back in all five SPBD member businesses impacted by COVID

countries (Samoa, Tonga, Fiji, Solomon Islands & Vanuatu). I restrictions

look forward to meeting face-to-face once again with all of SPBD Fiji’s BLOOM business accelerator

our teams and many of our wonderful, inspired members. programme graduates its first group of

participants

34 Islands Business, December 2020